Acts of casual carelessness include the following:

Shattering a glass in a coffee shop, triggering a traffic accident due to negligence at traffic lights, or any other similar incidents. If you have a pet, like a dog or horse, you must separately insure them so that you can receive compensation from the insurance company and cover losses if they cause trouble. However, it does not cover hunting, which requires additional coverage.

The length of outsider confidential responsibility protection is normally either three or five years. It should be noted that your contract cannot be terminated before the end of its term. Therefore, using an annual insurance is preferable because it can be extended or cancelled at the end of the year and gives you more flexibility.

Household insurance, which can compensate you for property damage or loss, is another useful type of insurance. Here, nearly everything is included in the term “property”: dishes, clothes, appliances, windows, and so on and so, you are not responsible for the insurance of anyone else’s property that is located on your household territory.

Keep in mind that if you are leaving your home for more than sixty days, you must notify your insurance company.

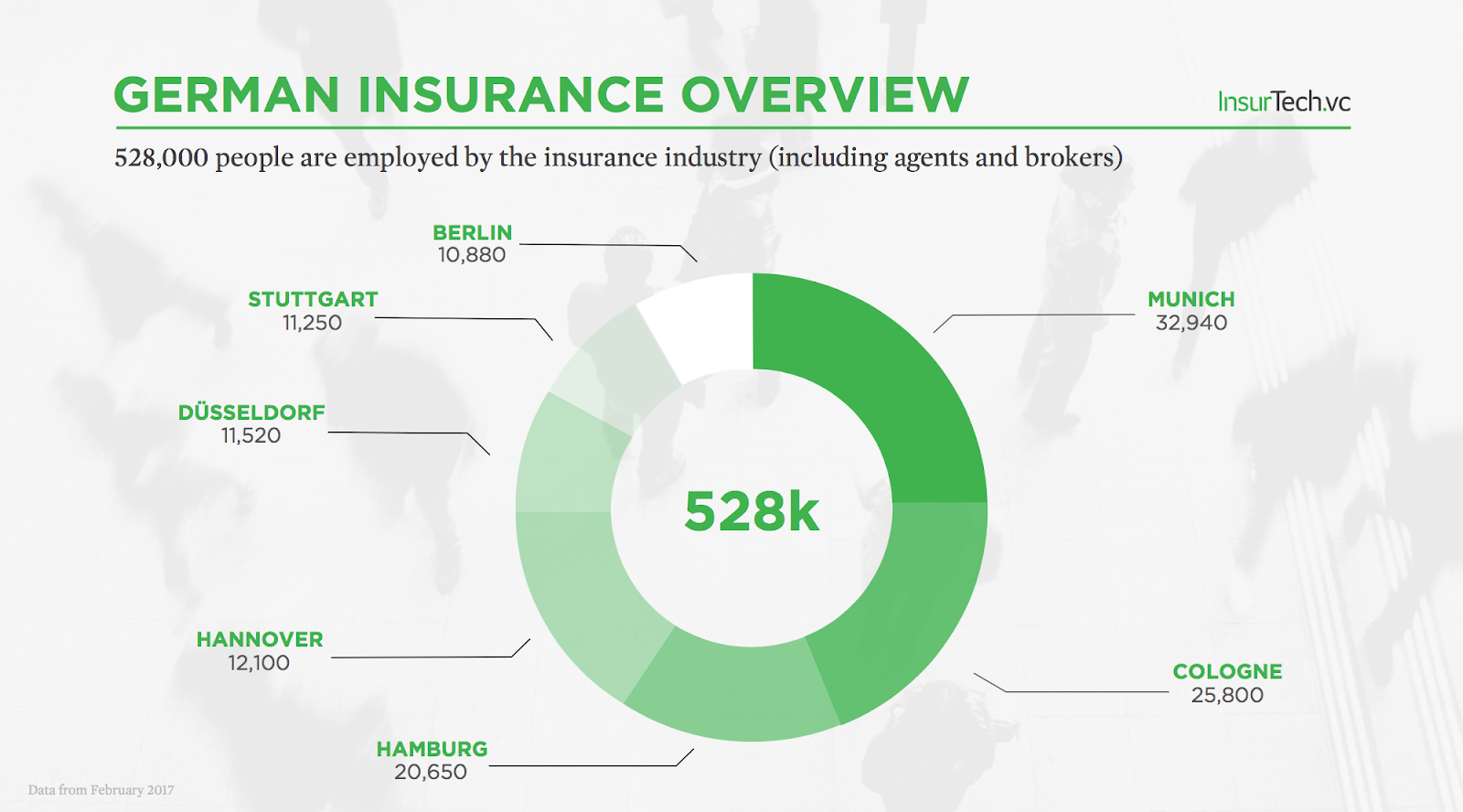

Insurance System in Germany

If you rent a house or a flat, keep in mind that your household insurance will not cover the cost of replacing the damaged property. You can use complicated insurance policies that cover a variety of damage types if you have expensive items.

Insurance is almost a requirement for cyclists in Germany due to the high number of bicycle thefts. If you own two or more bicycles, having such insurance is also beneficial.

The duration of the household insurance, like the one before it, is either three or five years, and you can’t cancel it before it ends. So, once more, it’s best to use an annual insurance so you can quit if you want to.

Legal assistance insurance is a very useful insurance for foreigners living in Germany.

Insurance for legal assistance covers all court costs. It is important to note that trials in Germany are costly. The amount in dispute typically determines the amount of fees. For instance, if it totals 10,000 euros, the fees may even reach 9,000 euros. Therefore, the insurance company will cover your costs if you have legal assistance coverage. Additionally, such insurance typically covers losses resulting from disagreements with tax authorities, landlords, inheritance advice, and other similar events.

Although it is evident that life is far too unpredictable to be careless about, most people try to avoid even thinking about it.

Compensation for injuries like losing a finger is 30 percent of your annual income, while compensation for losing a leg is 50 percent, and total blindness is 100 percent.

Term life insurance is another option because it compensates your loved ones in the event of your death. Any cause of death is eligible for reimbursement. The insurance itself doesn’t cost much. You must disclose your medical history to the insurance company in order to obtain it.

Annual travel insurance will come in handy if you travel a lot. It offers comprehensive insurance for each trip. You face no limitations on where to travel, how and how frequently.

If you have annual travel insurance, it will reimburse you if you have to end your trip earlier than planned. It would be prudent to purchase annual travel insurance that covers expenses related to hospitalization and emergencies.

The services that insurance companies provide are extremely diverse. For more data it is smarter to straightforwardly reach them.