An Optional Market Annuity, often referred to as an OMA, is a financial product designed to provide individuals with a reliable stream of income during retirement. OMAs are essentially a type of annuity that allows retirees to choose from a range of investment options within their annuity plan. This flexibility sets OMAs apart from traditional fixed annuities, which offer a fixed interest rate and fixed payments.

Here are some key characteristics of Optional Market Annuities:

Investment Choice:

With an OMA, retirees have the option to allocate their funds among various investment options, which may include stocks, bonds, mutual funds, or other assets. This choice allows individuals to tailor their investment strategy to their risk tolerance and financial goals.

Income Stream:

OMAs are primarily designed to provide a steady stream of income during retirement. Retirees can select how they want to receive their payments, such as monthly, quarterly, or annually.

Tax Benefits:

Like other annuities, OMAs offer certain tax advantages. The growth of your investments within the annuity is tax-deferred until you start receiving payments. This can help you maximize the growth potential of your retirement savings.

Flexibility:

OMAs can offer more flexibility than traditional fixed annuities. Depending on the specific OMA plan, you may be able to make changes to your investment allocations over time or access a portion of your funds in case of emergencies.

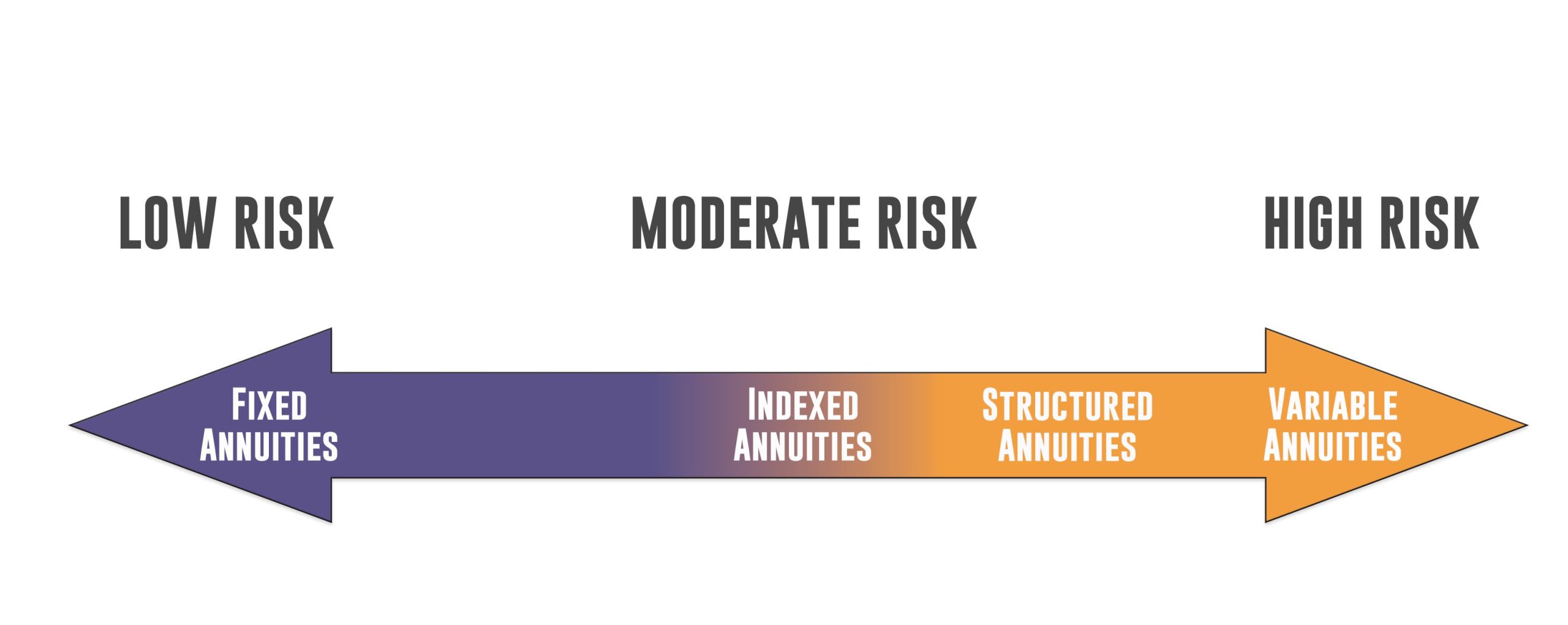

Market Risk:

It’s important to note that OMAs are subject to market risk. Since they allow for investment choices, the performance of the underlying assets can affect the value of your annuity and your income payments. If the investments within the OMA do not perform well, your income may be lower than expected.

Professional Management:

Some OMAs offer the benefit of professional portfolio management. This means that investment professionals actively manage the assets within the annuity to optimize performance and reduce risk.

Death Benefits:

OMAs may also provide death benefits that allow beneficiaries to receive a portion of the annuity’s value in case of the annuitant’s death. The specifics of the death benefit can vary between OMA providers.

Optional Market Annuities are designed to offer retirees more control and flexibility over their retirement income while still providing a level of security. However, it’s essential to carefully review the terms, fees, and investment options associated with any OMA you consider to ensure it aligns with your financial goals and risk tolerance. Consulting with a financial advisor or retirement planner can also be beneficial in making informed decisions about OMAs.

That means you’ll perceive some fresh features and from access to additional channels where you can forward movement visibility, without having to make nous of some confused, manual migration process. https://googlec5.com